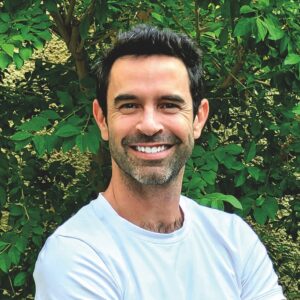

Corry Banks was always a creator.

As an emcee in a hip-hop group, he created rhymes. As a beatmaker, he created the sounds to go with the rhymes. And now, as the founder of and visionary behind Modbap Modular, Banks is creating the various tools that serve as instruments for the world’s beatmakers.

“I’ve always made beats on MPCs (music production centers) and obviously collect them” – Banks says as he gestures to the plethora of rare and classic synthesizers and MPCs in his home studio – “and what I started getting into was sampling. That’s the name of the game in hip-hop. Because I have a tech background and that I’ve always done hip-hop, it just felt like, ‘Oh, that’s my two worlds coming together.’”

Banks’ business, which he runs out of his Santa Clarita home, has gotten attention. Modbap products are sold in more than 40 electronic instrument stores in North America, Europe and Asia. Late last year, Modbap was one of three winners in the Famous Amos Ingredients for Success Entrepreneurs Initiative, which came with a $50,000 grant.

Entering his sixth year with the business, Banks says he has new products in the pipeline for his aficionado customer base. Longer term, he says he would like to establish a formal headquarters to accommodate continued growth.

Finding his voice

After moving to Los Angeles in 2006, Banks familiarized himself with the music scene through his rap group.

As a songwriter and performer, he was used to the showmanship aspect of the business. He even tried his hand at making a beat once but stuck with the vocal side.

However, the seed was planted. He thought about the classic hip-hop production – a drumkit, plus the records you wanted to sample – that was behind the boom bap style, so-named for the drum pattern that punctuated the audio. But then he also thought about European dance and techno music, which used Euroracks – a collection of modular synthesizers – to create more melodic experiences. Think J Dilla – the legendary Detroit producer who once worked with South Los Angeles alternative darlings The Pharcyde and whose beats you might have heard as Adult Swim interludes. Or maybe of RZA’s soul samples for Wu-Tang Clan and Pete Rock’s jazz-infused beats. It’s what Banks did.

“Eurorack is very experimental. I want to make tools that not only help you experiment but be melodic. There was a point where a lot of this stuff was obviously not the kind of music that I make, but it’s music that I respect,” Banks explains. “I really wanted to make something that lives in the context of the type of music that’s boom bap and that sort of thing. As time goes on, I’ve gotten a lot of people who are beatmakers who are jumping into more modular stuff and want to incorporate this stuff into what they’re doing.”

This set Banks on the path to blending the two together, down even to the name of his company being a portmanteau of “modular” and “boom bap.”

In the customary approach of the time, he began to blog about his thoughts on the music and his reviews of certain pieces of equipment. On top of his flair for music, Banks also holds an academic background as a technologist.

“Because I’m kind of a techie and kind of gadget guy like that, I was always looking at, what are the latest things that are out there, and so I started blogging about the things, because I just didn’t hear my perspective and my voice, like from a hip-hop perspective,” he says. “I think now that it’s 2025 that’s changed drastically. We’re talking about 10 years ago now.”

In reviewing or beta testing products, the name of the game is that those companies will incorporate that feedback. Banks started seeing his influence manifest on those products.

“Some of those ideas live with those products, and it started making me think, ‘I could do this,’” he recalls.

Building a business

Banks has the acumen to design the modules – which, visually, are essentially metal blocks with dials, switches, buttons and line jacks. The sounds and effects can vary greatly between models, hence the development of the modular Eurorack system; creators can assemble a unit based on their preferred modules.

Once he’s designed them, Banks works with a manufacturer in San Clemente to produce them. He handles distribution himself.

Since coming online in 2020, Modbap products have gone from being available in a handful of stores to now more than 40 across three continents. Though declining to cite specific sales figures or revenue, Banks says last year his distribution footprint grew between 15 and 20%.

Modbap got another boost last year as well. The company was among three winners of the annual Ingredients for Success Entrepreneurs Initiative by Famous Amos.

The initiative, which is done in partnership with U.S. Black Chambers Inc., invites Black entrepreneurs to pitch their businesses to judges. More than 2,800 applied, and those like Banks were keyed onto the contest through newsletters from U.S. Black Chambers.

“Because I was getting ready for a new product and an event, I saw it and was like, I got a million things to do,” Banks admits. “I just kind of thought to myself, ‘I’ll apply for that,’ but I kind of blew it off, because I was really getting stuff together. I was in the midst of a development cycle, in the midst of getting stuff for my booth and making sure everything was right.”

Banks eventually buckled down and recorded the video pitch one Saturday morning, with just days to spare. He would eventually become one of the 10 finalists and then one of the three winners.

“That grant money, it’s going to help in a lot of ways,” he says. “I need to keep my inventory up. I need to be able to invest in development, to kind of finish products that have come out. I have goals to expand the product line.”

Eyes on the future

Banks’ home studio looks the part. On top of his various Modbap products, a plethora of classic and vintage MPCs and synthesizers decorate the space tastefully, including an Akai MPC3000 that was J Dilla’s beloved choice of instrument.

“I’m kind of a collector and gear hoarder,” Banks quips.

Nevertheless, the goal one day is to have a formal business location, and not one tucked into a Santa Clarita cul-de-sac.

“That’s a dream of mine, is to be able to have a Modbap office,” he says. “Right now, I’m doing the American dream, distributing out of a garage, heavily utilizing Zoom calls with developers, but it will be nice to have everything in a ‘proper place.’”

One advantage to having more space and more people, he says, is that it would allow him more leeway to jump into different platforms: desktop units, which are simpler condensed modules meant to be more accessible to those of casual interest, as well as other accessories like instrument pedals.

When the time comes for an office, Banks says he wants to stay in the Valley area.

“I don’t want a long commute,” he says, with a laugh. “I love the idea of being offset, away from the hustle and bustle a little bit. I envision a warehouse, and there’s a lot of business parks up here.”

As more artists add the brand to their repertoire – Modbap counts Ski Beatz, who has produced for key names like Jay-Z, Lil’ Kim and Mos Def, as perhaps its most well-known endorser – Banks says he is open to bringing in more minds and artists to work with him on products.

“I’ve had conversations with a couple of creatives. We’ve talked about doing collaborative projects and I’m totally open to that,” he says. “I think there’s something special about that. I feel like it’s almost like an experience. I’m a huge sneaker fanatic and I love the idea of ‘brand gets with designer, creates thing.’ For people who know the brand and the designer, the thing becomes something to experience.”